The Arlington Tax Services PDFs

Table of ContentsTax Office Near Me - An OverviewThe Of Affordable Tax ServiceThe 2-Minute Rule for Irs Tax PreparerBest Tax Services In Arlington Tx - The FactsLittle Known Questions About Tax Services 76017.The Ultimate Guide To Irs 76001

Countless Americans pay a tax obligation specialist to prepare and also submit their income tax return annually. As the number of taxpayers remains to grow, so does the need for qualified tax preparers that can aid their clients declare all the credit scores and reductions due them and pay no even more than taxes they owe.Once you have actually built trust as well as relationship with your customers, it's very easy to offer them these additional solutions that will assist bring in profits year-round. This 319-page publication is your go-to guide to obtaining started with a tax company today! "One really vital point I have discovered over the years is that there is no need to change the wheel.

Throughout this publication, you will discover numerous finest practices that will save you money and time, as well as help you grow a successful tax service." Chuck Mc, Cabe, Creator, The Earnings Tax School.

The Definitive Guide for Irs 76001

BDO experts supply a wide variety of totally incorporated tax obligation services to clients worldwide.

This is a than Glacier Tax Obligation Preparation! If you currently have a Glacier Online Tax Compliance account, you will be able to gain access to Glacier Tax Preparation by going with that account.

The University of Washington does not provide tax guidance and therefore disclaims all responsibility from the misinterpretation or abuse of GTP. Tax obligation specialists as well as certified tax accountants, that bill for their services, can assist you with your tax obligations. Washington state does not have a state earnings tax. If you worked in a state that has state revenue tax obligation, Glacier Tax Preparation (GTP) has a link to another firm that will certainly determine your state revenue tax obligation.

The Facts About Affordable Tax Service Revealed

The web link is on the last web page of GTP after you complete all the concerns for the federal tax obligation return. If GTP identifies that you are a, please click the web link given by GTP as well as most likely to Free Data: Do Your Federal Taxes free of cost as well as select a firm - IRS Tax Preparer.

Glacier Tax Obligation Prep, a check my blog tax software program, will certainly count the number of days you have remained in the U.S. and also figure out if you are a resident or nonresident for tax purposes. Please note that if you worked with campus you utilized, a secure, online application to identify the proper tax on wages for foreign national staff members.

The Arlington Tax Services Diaries

ISS advisers are migration experts and are not allowed to give tax obligation guidance which is why we acquire Glacier Tax obligation Prep to aid you with this process. If you have inquiries regarding exactly how to use the software program, please most likely to the GTP Tutorial Video clips link on the welcome web page of Glacier Tax Prep.

The only method to obtain this cash returned to you is to submit an earnings tax return. In this instance, you will require to pay the added amount.

Tax Office Near Me for Beginners

That is why it is vital you could check here to submit your taxes yearly. Also if you did not work as well as do not owe any taxes, you might require to send an educational form to the internal revenue service. U.S. tax regulations can be complicated as well as confusingwe all obtain migraines throughout tax obligation seasonand the regulations that relate to international trainees are not the same as those that put on U.S.

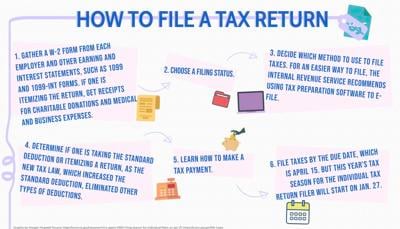

Prior to you begin the declaring process, make certain you have all the required information with you. W-2 forms are mailed to current and also previous staff members. This type demonstrates how much you made in 2015 and just how much was taken out for tax obligations. You will only get this type if you have actually been used.

Income Tax Near Me for Beginners

The 1042-S type will just be provided to nonresident alien pupils who have actually gotten scholarship or fellowship cash that exceeds tuition and also relevant fee charges. You will certainly not get a duplicate of the 1042-S form if you only have a tuition waiver on your account as well find as do not get any checks. Income Tax near me.

These classifications are for tax obligation functions only as well as are not related to your migration status. You may be in F-1 or J-1 non-immigrant condition and taken into consideration a homeowner for tax obligation functions. Homeowners of these nations might be strained at a minimized price or be exempt from United state revenue tax withholding on certain kinds of United state source earnings.